SPHERES | A suite for Capital markets management

Our third generation of our products leans on a new framework, completely designed and developed by our teams.

Designed according to business standards handling a wide variety of vanilla and exotic instruments,

and compliant with the needs of multiples actors and their market practices, the Spheres suite is fully configurable and

on-site customizable and cover all trade lifecycle events through a flexible Straight through processing workflow.

Destined to all categories of participants in organized markets (ETD) and over-the-counter (OTC), this new range offers products for a specialized management

LIFECYCLE | Front to Back Processing

Provide a full management of the entire trade lifecycle with a flexible schedule of all steps.

-

Coverage: fixed income, floating-rate notes, money markets, foreign exchange, equities, derivatives...

-

Trade input: quick, full or custom manual entry,automated import, fully customizable

-

Fee & brokerage: any commission or brokerage directly calculated through standard or specific scales

-

Cash-flows: maturities, resets, premiums, interests, notionales... generated just in time and always available

-

P&L : accrued interests,depreciation, mark-to-market, variation margin

-

Confirmation: fax, email or electronic networks using ISDA, SWIFT or specific formats

-

Settlement & delivery: cash amounts and securities using FIX, SWIFT or specific formats

-

Options & provisions: automatic or manual exercise, barrier,early termination, extendible, cancellation...

-

Risk: collaterals management and initial margins calculations (intraday,end of day...)

-

Invoicing: periodic invoices (draft & final), discount, automatic credit notes, settlements...

-

Accounting: standard events report and/or final entries from the entity accounting schemes

-

Status: provide and manage multiple custom status (checking, matching, processing, ...)

-

Reports: standard and custom reports using open tool, output PDF, Excel, Text, Web, ...

CONNECTIVITY | See Pattern

EDITIONS | See daily summary report model

AUTHENTICATION & SECURITY | Users, Roles and profiles

-

Authentication: software, rdbms, active directory, LDAP

-

Roles: administrator, user, client, guest...

-

Profiles: time slots, restrictions to access menus, actions, data...

MONITORING & AUDIT | Exhaustive capabilities

-

Monitoring: controls the execution and result of each Straight through processing (Success, Warning, error, ...), raise exception and send alerts

-

Audit: tracks any change on trade or repository, including its author,hostname, time

-

Analysis: compare several versions of a trade or repository and display their difference

SYSTEM INTEGRATION | Normalized open architecture

-

Deployment: easy integration in your information system, with a high level of exchange and scalability through our Spheres I/O component or any external component

-

Input: trades, market data, repositories... for Front-to-Back and Straight through processing solution

-

Output: trades, P&L, accounting, financial reports... to feed risk management and compliances systems

-

User interface: full design or customization of windows layout and reports

-

Business: invoke Spheres business services from external system (Biztalk, Control-M, WebSpheres...)

-

Interoperability: interact with multiple web services (FlyDoc, Gateways, Market data, In-house...)

-

Data: available from open database (MS SqlServer, Oracle, ...) which can be shared with other applications and enriched if necessary

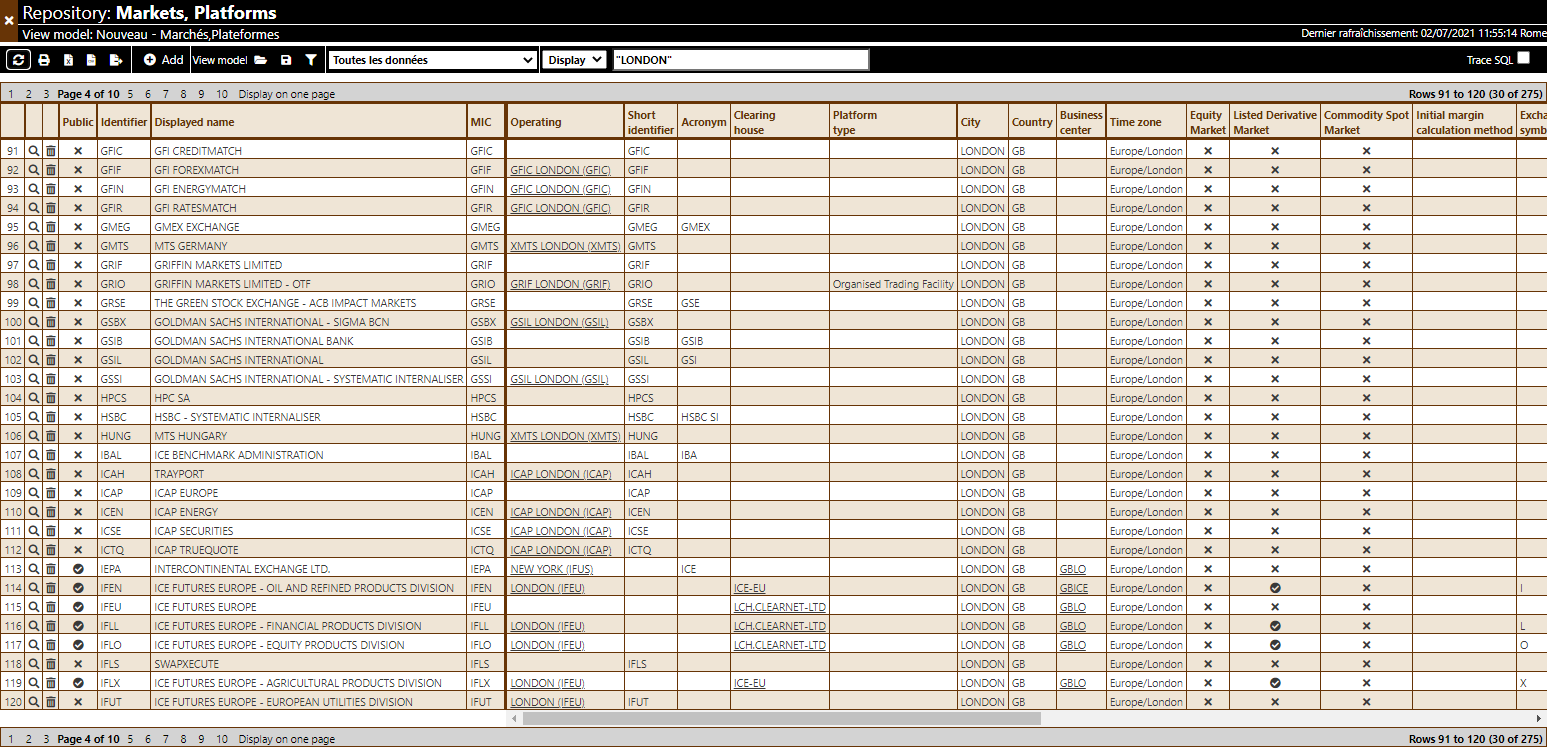

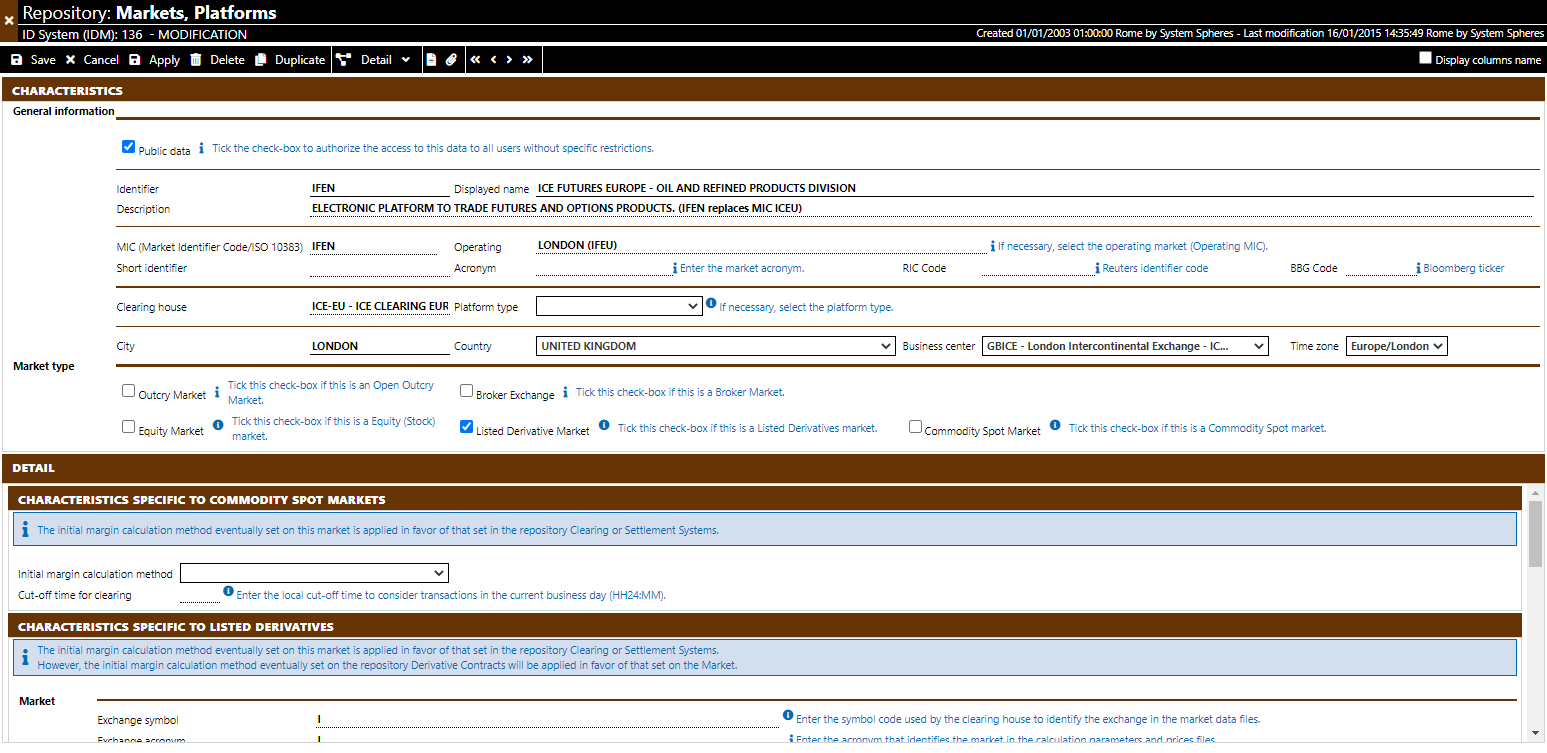

REPOSITORY | Business normalized and customizable

-

Multi-entity and accounting: unique multi-entity repository for all instruments, market data, clearing and settlement systems...

Financial reporting and multi-accounting standards shared or specialized by entity (Local, GAAP, IFRS...) -

Actors/Books: exhaustive management of n-level hierarchical and transversal relationships between actors to fit each organization (counterparties, correspondents, clients, brokers,traders, sales,desks, clearing houses...)trades, market data, repositories... for Front-to-Back and Straight through processing solution

-

Multilingual: adjustable management ata very fine level - user, correspondent, office, according to the adressee and the type of document sent (en-GB, en-US, es-ES, fr-BE, fr-FR, it-CH, it-IT ...)

-

ISO and standard codes: available on any data simplifying dialog with all external systems (BIC, IBAN, MIC, ISIN, AII, FIX, 15022, 20022...)

-

Customizable: external link, notepad and attachments available on any data to centralize all necessary information on relevant elements (External references, formula, notes, master agreements, confirmations, fax ...).

Fully customizable on site including additional data, mandatory/optional/restricted value, default value, additional repository...

REPOSITORY | See examples

KEY FEATURES

Main functional and technical advantages

-

Rich, evolving and open database

-

Conformity of instruments to the ISDA®, FIX®, ISO-20022... definitions

-

Native integration of the new standards FpML®, FIXML®...

-

Fully compatible to SWIFT® and to the ISO communication standards

-

Up-to-date technology

-

Evolving system

-

Security and ever-lasting technological choices

-

Flexible to use

Main technical aspects

-

Web technology, no software installation is required on the user machine

-

Hightly interaction between process and systems thanks to XML

-

Easy to use and communicate thanks to STP concepts

Conformity of instruments to the ISDA®, FIX®, ISO-20022... definitions

-

Integrated software solution for the management of all types of financial instruments

OTC derivatives: Swap, Cap/Floor, Forward, Equity, CFD, CDS...

Exchange traded derivatives: Futures, Options, Strategies...

Securities: Bonds, Bills, Stock, Repo...

Cash: Spot, Loans, Deposits, Certificate of deposits... -

The security provided by a common standard language OTC market

1998/2005 FX and Currency Option Definitions

2000/2006 IRD, Currency Swap, Option Definitions

2002/2011 Equity Derivatives Definitions

2003/2009 Credit Derivatives Definitions. Other specific recommendations (ex.: Credit Support, Netting, Novation, Risk Management, ...) -

The interoperability provided by FIX®, standard common to the ETD and Securities

Market Data, Trades, Positions

Native integration of communication standards

-

Storage formats trades: FpML®, FIXML® or XML

-

Data modeling and market risk in accordance with FpML® and FIXML®

-

Full Compatibility ISO 20022/UNIFI (trade and repository)

-

Full Compatibility SWIFT® (all messages 7775, 15022 and 20022)

Flexibility

-

Menus complying with the requirements and clearances of each operator

-

Multiple screens capture for each instrument, fully redesignable by user

-

Screens customizable reports and consultation by a simple parameter adjustment

-

Multi-language: English, French and Italian are available

-

Multi-entity